Bill vs Invoice

Key Differences and Best Practices

Are you often using the words invoice and bill interchangeably? Do you find it difficult to tell when you need an invoice vs bill? You’re not alone. Thousands of entrepreneurs find themselves confused at the billing and invoicing process, wishing for a shortcut. Fortunately, there’s no magic; only facts, and in this post, we guide you through the difference between invoice and bill to help you streamline your business processes.

Table of Contents

Key Differences

Common Misconceptions About Invoices and Bills

Why Businesses Should Automate Invoicing and Billing

Best Practices for Invoicing and Billing

While invoices and bills have lots in common, they are not the same in business. As a beginner entrepreneur, you may find yourself asking, “Is an invoice a bill?’ These terms are used often and sometimes interchangeably. However, the difference between bill and invoice affects your overall order management cycle and is, therefore, critical to understand.

An invoice is a formal document a seller sends to a buyer to request payment for goods or services. Invoices show a list of all purchased items or services, their quantity, prices, the total amount due from the purchase, plus relevant discounts and taxes. Invoices also include terms of payment, the seller’s and buyer’s contact details, invoice number, and issue date.

As a business owner, you use invoices to balance your financial books, manage client relationships, and inform business strategy.

Want to learn more about what an invoice is and how it works? Check out our detailed article.

A bill is a document a seller issues a buyer detailing the services and goods rendered for immediate payment. Bills list all the goods and services provided, including discounts and taxes, plus cashier and payment method details. They are commonly used in retail businesses, grocery stores, and restaurants and are usually issued after the completion of the sales transaction.

However, it should be noted that while a “bill” usually refers to a one-time proof of payment, it can also occur regularly. Subscription services like internet, electricity, and cable providers issue bills to customers. These types of bills occur in cycles and usually act as reminders for due dates before the service cuts off.

Also, sometimes, you’ll come across terms like “invoice billing” which can bring more confusion. However, in this case, billing refers to the entire process of a business charging for their goods and services, including creating the invoice, sending it to the customer, tracking it, and collecting payments.

If you want to know if it is an invoice or bill, look at the application. Bills have a one-time use. Suppliers and vendors give buyers bills to request payment for services in the short term, often including the next billing date, amount due, or due date before a subscription expires.

Sellers send buyers invoices to request payment for goods and services long before payments are made. They add payment terms like “All invoices should be paid within 30 days from the invoice date”.

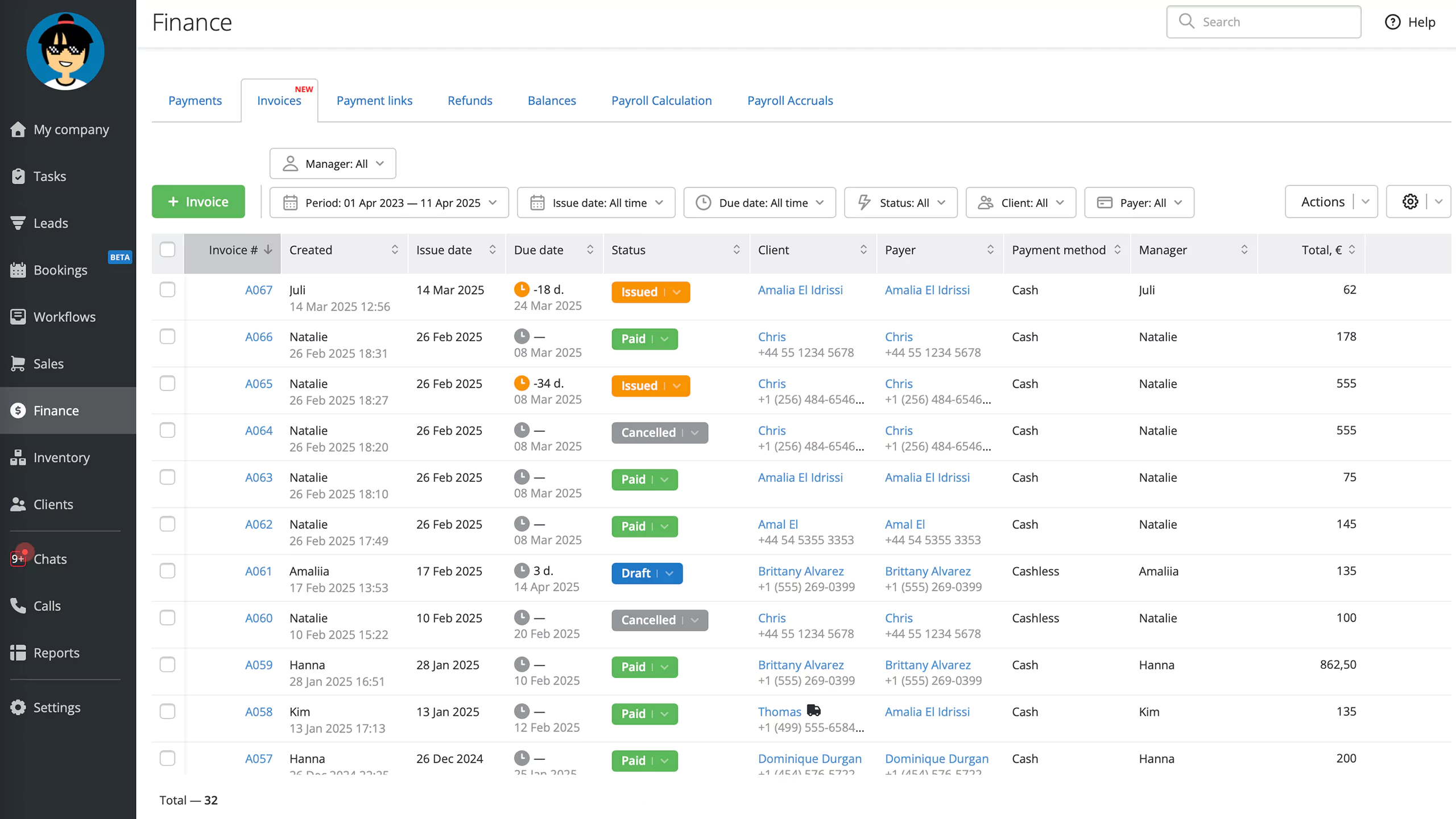

RemOnline online invoicing software helps entrepreneurs streamline invoice and billing processes by keeping accurate customer data, sending invoices and bills on time, and setting payment collection reminders. By leveraging the right tools, you can manage your business more effectively and compete in the market, while maintaining a complete overview of the order and sales process.

Invoice tracking and management in RemOnline

Invoice tracking and management in RemOnline

Take control of your invoicing today.

Streamline your financial processes with automated invoicing, reminders, and real-time tracking in RemOnline.

Key Differences

Here is a summarized version of the key differences between invoices and bills as they show up in a small business CRM.

Invoice

- An invoice is a legal document a seller issues a buyer requesting payment for goods or services in long-term agreements.

- The document lists the services, the quantity, prices, discounts, and taxes.

- Invoices also include the seller’s and buyer’s contact details, terms of payment, invoice number, and date of issue.

- As a business owner, keeping an accurate record of all your invoices helps you follow up on payments, track sales, and manage your financial and legal obligations.

Bill

- A bill is a document a seller gives a buyer requesting payment for goods or services in merchant transactions or subscription services.

- Bills are usually issued shortly before or after a seller receives payment and are relevant within the purchase window.

- Bills serve as a transaction record for the seller and the buyer because they include the goods and services, quantity, price, taxes, discounts, server, and cashier details.

- As an entrepreneur, keeping an accurate record of all issued bills helps you track your sales and cash flow. If you receive bills, keeping an accurate record helps you track and manage business expenses and get a better overview of your financial obligations.

Common Misconceptions About Invoices and Bills

Is an invoice the same as a bill?

Invoices and bills are different documents but are often confused in business because they both itemize the products and goods sold. However, the main difference lies in the context.

Bills are common in merchant and retail transactions and contain few details for one-time or recurring purchases. Usually, the customer is expected to pay immediately after receiving the bill, for example, in a store or restaurant or within a few days for an internet subscription.

An invoice is a legal document common in business-to-business transactions where a seller sends a list of goods and services sold for future payment. Invoices also included accurate business details such as the buyer's and seller’s addresses, contact details, banking information, and terms of payment. These details help streamline accounting, taxes, and financial management.

Sometimes, the difference lies entirely in your perception. For example, if you issue an invoice to a customer, it becomes a bill to them. Likewise, as a business, you issue invoices to other businesses or bills to customers and also receive bills from service providers. It all varies depending on who is demanding payment and who is paying.

Is a bill of sale the same as an invoice?

No, they are different documents. Here are the differences between a bill of sale vs invoice.

A bill of sale is a legal document that shows the transfer of ownership of goods from the seller to a buyer in exchange for payment. Bills of sale are more detailed than typical bills in merchant payments like retail shops and restaurants which are more like receipts. Formal bills of sale are used for selling items like vehicles, furniture, and electrical devices. Bills of sales are useful when purchasing items from individuals. They show legal payment and transfer of ownership when safeguards such as guarantees are unavailable.

A bill of sale includes items such as:

- The identity of the buyer

- The identity of the seller

- The nature of the items and condition as seen

- The price of goods

- The date of sale

An invoice is a formal request for payment often issued for ongoing contracts. Invoices include legal details such as the buyer and seller’s addresses and contacts, a description of the goods, prices, taxes, discounts, and payment terms. As a business owner, you need invoices to follow up on payments and can use them in court as acceptable evidence.

Is an invoice a legal document?

Yes, an invoice is a legal document. It is an itemized document that includes goods or services provided plus extra details like:

- The seller’s and buyer’s addresses

- The seller’s and buyer’s contact details

- Invoice number

- Date of issue

- Goods and services sold

- Taxes, discounts, and fees

- Total amount due

- Payment terms

- Due date

- Payment methods

- Seller’s and buyer’s signature

Why Businesses Should Automate Invoicing and Billing

Managing accounts is a crucial part of maintaining accurate records, paying suppliers and partners on time, plus avoiding extra fees. If you’re using manual invoice processing, chances are you’re not exploiting maximum efficiency. Some of the common challenges of manual processing include:

- Payment delays: Manual invoicing often causes delays due to back and forth between departments. Sometimes, errors occur, and people forget to send and respond to invoices, causing penalties and injury to business relationships.

- Fraud: Invoices present a great opportunity for fraudsters to issue fake payment requests and manipulate invoices in collusion with suppliers.

- Missing invoices: Manual invoices are easily lost from filing systems that are susceptible to human negligence, theft, and damage from elements like fire and water. Unfortunately, missing invoices means missing or delaying payment requests, making payments to the wrong suppliers, hurting business relationships, and losing track of cash flow.

- Duplicate payments: Double payments are common when invoices are doubled during entry. Sometimes, a supplier may send two invoices due to payment delays, and you may pay both.

Say goodbye to manual invoicing issues! Book a demo with our expert and see how RemOnline can simplify your process.

Invoice and billing automation helps businesses promote faster and more efficient payment processing and cash flow management by:

- Faster invoice creation: Invoicing software helps you create custom invoices for your businesses, which you can use to generate documents for different customers. You don’t have to worry about design or consistency when using digital invoices.

- Software integration: Automated invoicing software syncs customer details with accounting, customer-relationship-management (CRM), and work order management software for accurate identification and correct financial details and dates. With better information availability, you can prevent errors and invoice doubling.

- Automatic payment tracking: Invoice software helps you track invoices and send reminders for later payments for better cash flow management. With accurate reminders, you can avoid missing payments in your business and foster relationships with reliable buyers.

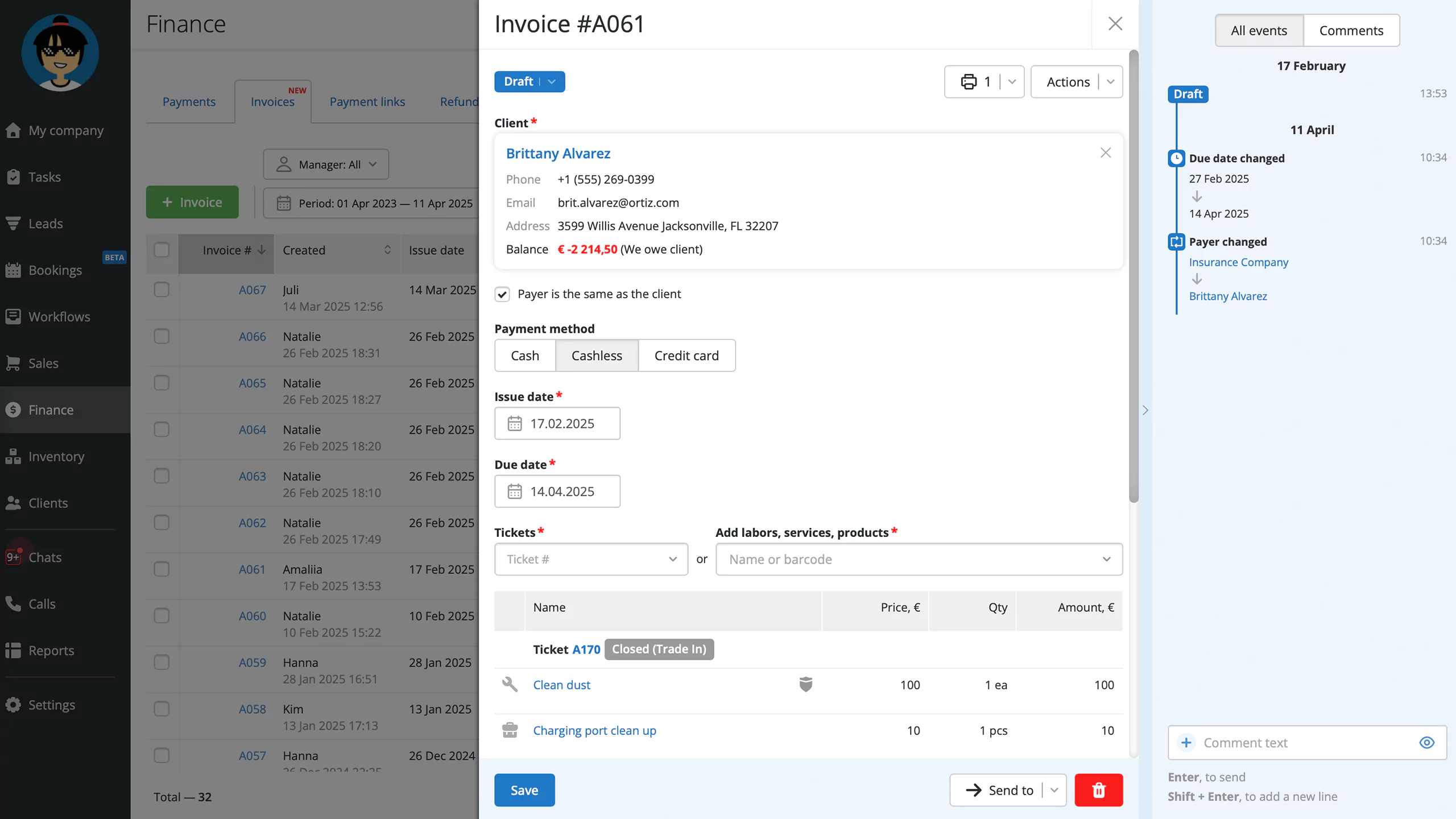

RemOnline’s invoicing solution helps entrepreneurs create invoices at the tap of a few buttons. The design allows you to reduce errors and speed up payments by using a consistent invoice format. You can carry contact details from quoting software or add a new contact if necessary. You can also select products to add to the Work Order from saved details about your products and services and adjust the prices according to the customer.

Automated data transfer from order to invoice in RemOnline

Automated data transfer from order to invoice in RemOnline

Ultimately, while manual and automated invoicing are built on similar accounting foundations, they function differently.

The manual invoicing process relies on human memory and capacity and is thus subject to human errors such as incorrect entries, double entries, and forgotten entries. Documents are also susceptible to loss, theft, and manual alteration without version history for editing to track changes to particular participants.

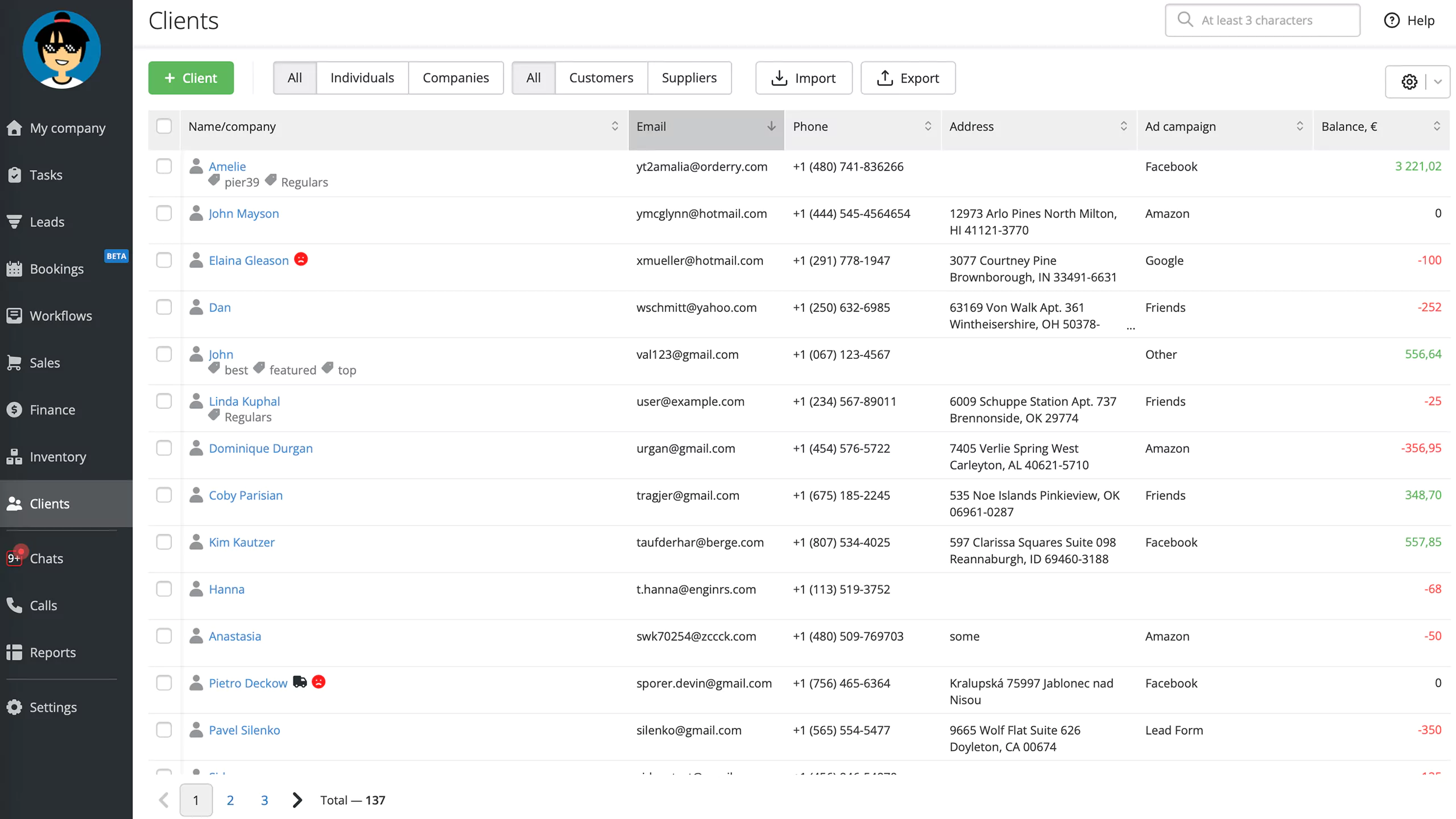

Automated invoicing and billing are incredibly convenient for both buyers and sellers. There is less need for printed documents, which means less paper costs and loss. Also, users can easily send documents back and forth to each other for faster communication and payment approval. There’s no need to wait days for a response or investigation when the entire billing cycle is accessible on a single screen. Also, by syncing details with your customer relationship management software, you'll know exactly how to manage a client when the billing process begins.

Detailed client and supplier information in one place

Detailed client and supplier information in one place

Furthermore, automated invoicing allows you to offload complexities such as invoice design and customization. Standard templates are easily available for beginners and customization features let you add your logo and business colors at no extra cost. You can also use software to scale your invoicing needs as required.

Lastly, for businesses with industry design requirements, you’re better off using accounting software to store the templates in a single, easily accessible location. Your accountants, tax experts, and financial managers will also have an easier time reviewing your documents and advising you accordingly. Alternatively, if you occupy all roles as a solo-prenuer, you can link your accounts to company insights for a birds-eye view of all your operations.

Best Practices for Invoicing and Billing

The main difference between invoices and bills lies in the nature of the business. If you are a merchant in a restaurant, retail shop, or internet, cable or electricity supplier, you send your customers bills. Bills have a short payment window, with many requiring immediate payments.

Invoices are formal documents from sellers to buyers as a formal payment request. They are common in B2B transactions, especially for services, where a business expects payment in the future after an agreed period.

Automated invoicing software helps you keep track of invoices, payment dates, taxes, and any other financial data for future disputes or queries. Invoice systems are crucial for generating invoices as quickly, accurately, and as similarly as possible.

If you’re still feeling a little lost, remember RemOnline is here to help. Our seamless invoice and bill management software helps you create, send, and track invoices. You can integrate Quickbooks, add and remove invoice permissions, customize invoice templates, and set payment reminders.